Limited Fiscal Representation

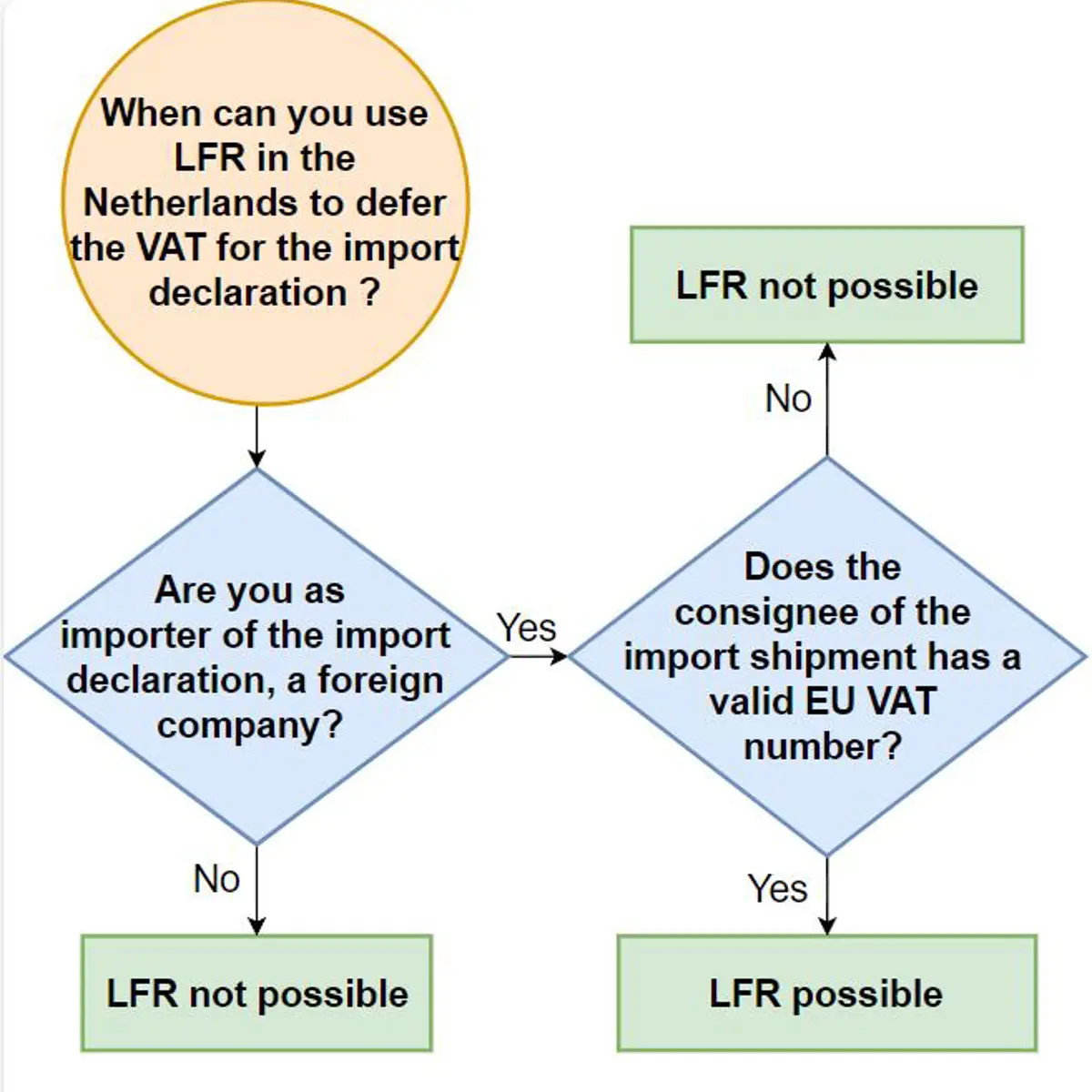

When importing goods into the Netherlands, while import duties must be paid at the time of import clearance, import VAT (Value Added Tax) can be deferred if a Limited Fiscal Representative (LFR) is used.

A Limited Fiscal Representative in the Netherlands helps foreign businesses manage VAT on imports and subsequent B2B deliveries within the EU. This allows foreign businesses to defer VAT payments, improving cash flow by avoiding upfront VAT costs at the time of import.

An alternative is General Fiscal Representation, which requires the foreign business to register for a Dutch VAT number and hire a firm to manage the process. However, General Fiscal Representation typically involves higher administrative costs and may not always be necessary.

Who can act as a Limited Fiscal Representative?

The Limited Fiscal Representatives must have in-depth knowledge of Dutch VAT laws and the expertise to ensure all VAT-related obligations are met for the transactions they manage. Below are some common Netherlands entities serving as LFR.

Customs brokers

Freight forwarders

Accounting firms

VAT advisors

How does Limited Fiscal Representation work?

Import process

The Limited Fiscal Representative oversees the import process, ensuring that VAT is accurately accounted for when goods enter the Netherlands.

VAT deferral

The LFR applies for an Article 23 license, allowing the foreign business to defer the payment of import VAT, rather than paying it at the time of customs clearance.

Reporting obligations

The deferred VAT is reported in the periodic VAT declaration of the LFR, while the EU recipient of the goods reports the VAT in their respective country.

Intra-community supply

Intra-community supply refers to the export of goods from the Netherlands to businesses in other EU countries. These supplies are subject to a 0% VAT rate in the Netherlands, with the purchaser in the receiving EU country responsible for paying the applicable VAT in their own country.

LFR service for non-Netherlands importers

We use LFR to do VAT deferment when arranging import declarations according to the situation. Want to know more about how it works?