Importer Of Record

When importing goods into the European Union (EU), the Importer Of Record (IOR), is the entity legally responsible for ensuring compliance with all relevant EU laws and regulations.

The IOR handles critical tasks such as customs clearance, payment of duties and taxes, and ensuring that imported goods meet EU standards for safety, health, and environmental requirements.

The IOR is linked to the Economic Operators Registration and Identification (EORI) number, which is required for customs activities in the EU. Without an EORI number, importing goods legally is not possible. It is issued by the customs authorities in the EU member state where the business is established and is valid across the entire European Union.

Who can act as the Importer Of Record in the EU?

In the EU, the following entities can serve as the IOR.

The owner of the goods

The company who owns the products being imported into the EU.

The consignee

The company that receiving the goods in the EU, often listed on shipping documents.

Third-party service provider

Specialized logistics companies in the EU can representing as IOR on behalf of the owner or consignee, a common choice when the actual importer lacks EU expertise or legal presence.

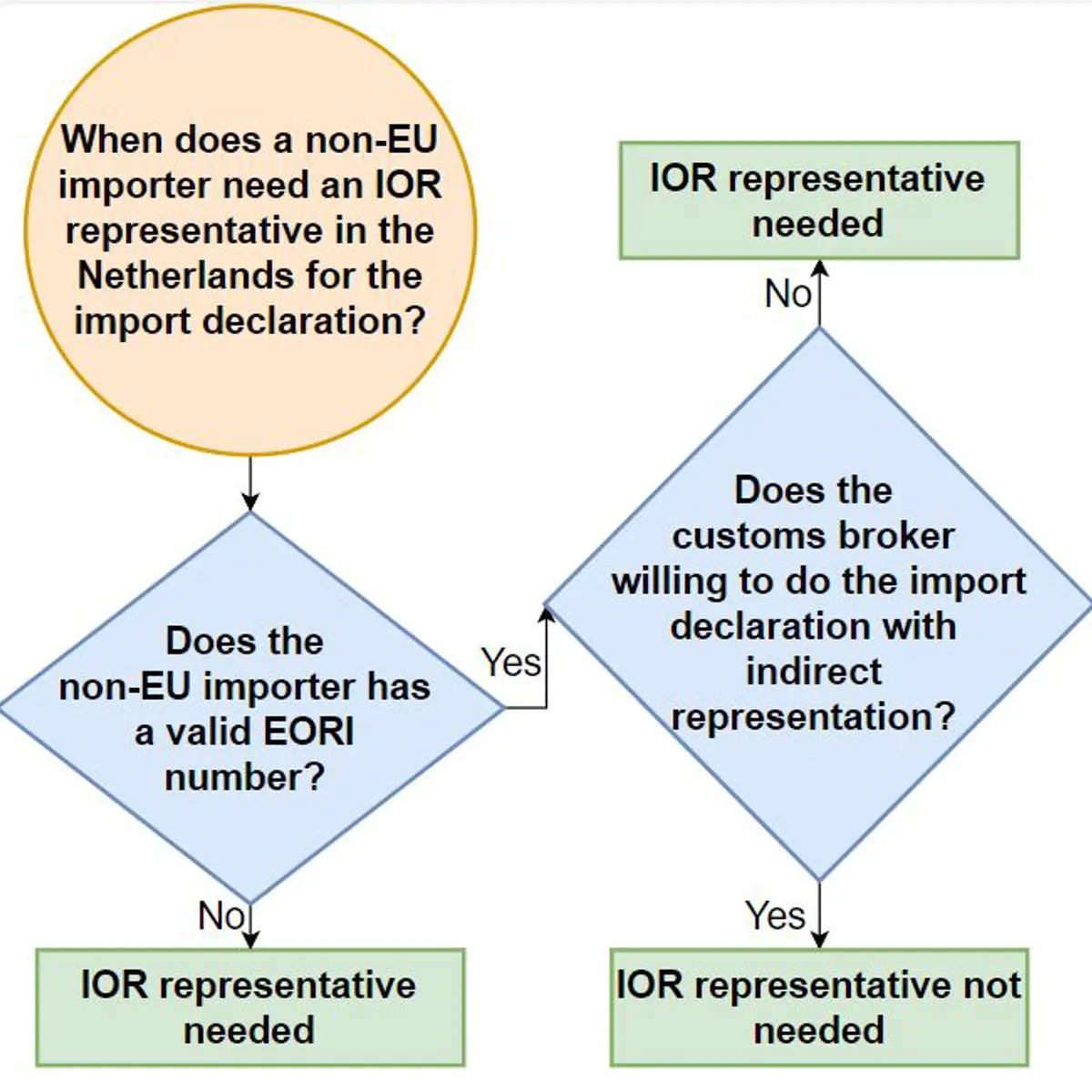

Forms of customs representation in the Netherlands

When importing goods into the Netherlands, there are three main forms of customs representation for import clearance, each with varying levels of control, liability, and responsibility.

Direct representation

The customs broker files a declaration in the name and on behalf of importer. Available only to EU importers with a valid EORI number.

Indirect representation

The customs broker files a declaration in their own name but on behalf of importer. This option is open to both EU and non-EU importers with a valid EORI number.

Self-representation

The importer files the declaration in their own name and on their own behalf, an option exclusively for Netherlands importers with their own customs declaration system.

Risks of indirect representation

Due to the potential risks and liabilities, most customs brokers avoid indirect representation. Non-EU importers are advised to secure a third-party service provider to represent them.

When are you considered an importer for customs clearance in the EU?

By following situations, you are considered an importer for customs clearance in the EU.

The seller under trade term DDP (Delivered Duty Paid)

The seller is responsible for handling customs clearance and paying all import duties.

The buyer under all other trade terms

The buyer is responsible for handling customs clearance and paying all import duties.

Importing inventory for later sales

Non-EU company brings goods into the European Union as inventory for later sales.

IOR representative service for non-EU importers

We manage customs formalities with the customs broker as IOR on behalf of the non-EU importer. Want to know more about how it works?