Carbon Border Adjustment Mechanism

The Carbon Border Adjustment Mechanism (CBAM) is a groundbreaking environmental policy introduced by the European Union to tackle carbon leakage and support its climate goals.

CBAM imposes a carbon price on imported goods from countries with less stringent climate policies, creating a level playing field for European industries and promoting global emission reductions.

CBAM currently targets high carbon emission sectors at significant risk of carbon leakage, including iron and steel, aluminum, cement, electricity, fertilizers.

Implementation timeline of CBAM

2021

The European Commission proposed CBAM as part of the European Green Deal and the Fit for 55 packages, aligning EU climate and trade policies.

2022

The European Parliament and the Council of the European Union debated and refined CBAM proposal, detailing its scope and implementation.

2023

CBAM officially took effect on October 1, 2023. Importers must now start reporting the carbon emissions associated with their imported goods, though purchasing carbon certificates is not yet required.

2023-2025

Companies are required to submit detailed emissions reports, allowing the EU to build a comprehensive emissions database and refine the system for optimal function.

2026

Full enforcement of CBAM begins. Importers must purchase and surrender carbon certificates for their imports, corresponding to the carbon emissions embedded in their products.

Post-2026

The scope of CBAM may expand to include additional sectors and goods, depending on its effectiveness and ongoing policy developments. The EU will continue to assess and adjust the mechanism to address new challenges and opportunities in global trade and climate policy.

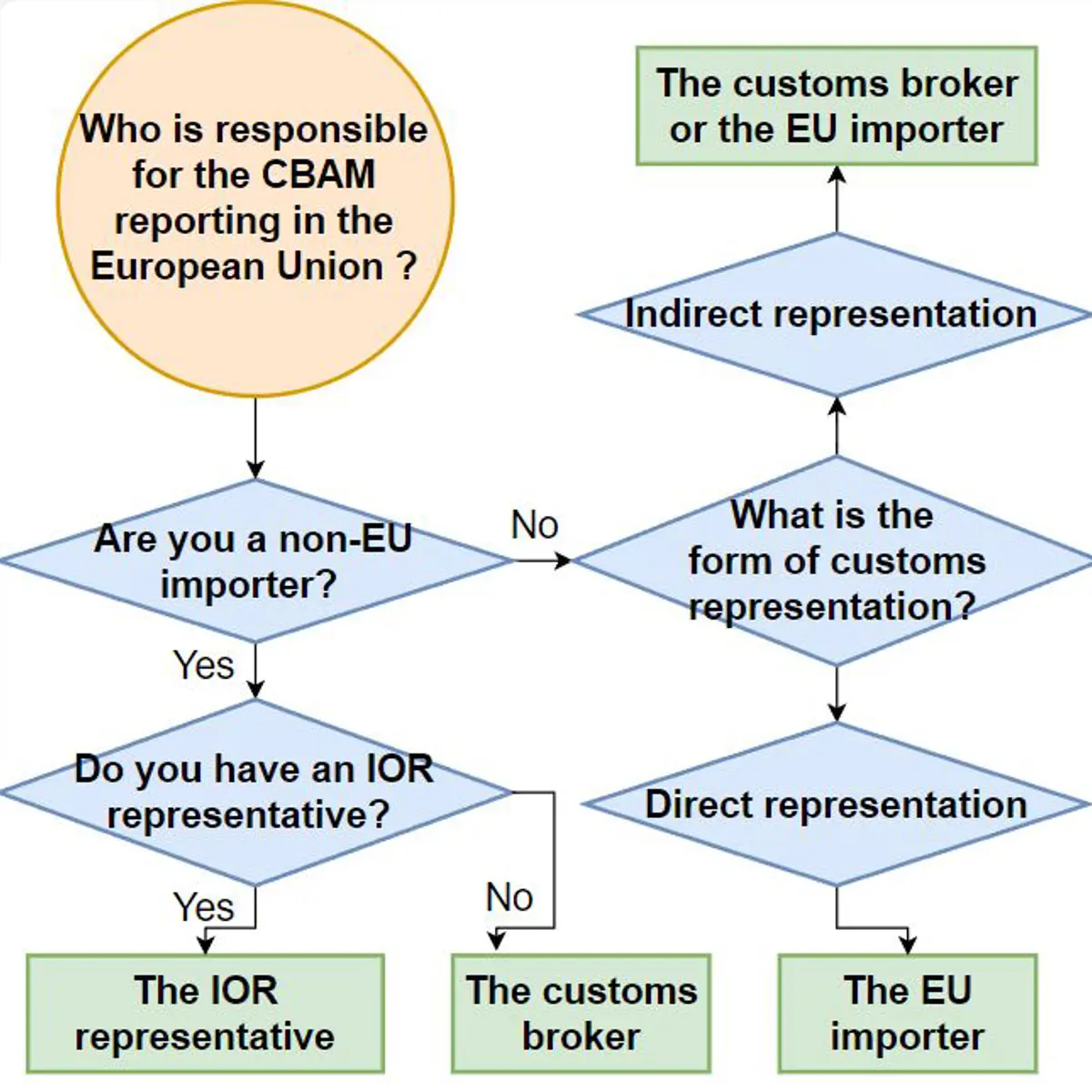

Reporting responsibilities

CBAM reporting responsibilities vary based on the type of customs representation.

Direct representation

The EU (represented) importer is responsible for reporting.

Indirect representation

For non-EU importers, the customs broker handles the reporting.

Self-representation

The EU (represented) importer manages their own reporting.

Reporting period

The Carbon Border Adjustment Mechanism reporting period is on a quarterly basis. Importers need to report the embedded emissions in goods covered by CBAM every quarter.

Reporting as IOR representative

At E8EU, we handle CBAM reporting obligations as the IOR representative for our non-EU importer clients. Want to know more about how it works?